4 Things To Know About Commercial Insurance and Mold Damage

3/30/2022 (Permalink)

Important Points Related To Insurance and Mold Issues

One of your most valuable assets for your business is your commercial insurance. The ideal policy protects your company from a wide variety of perils such as fire, water damage, vandalism and certain types of liability. The right policy makes sure that you will not be saddled with huge costs that can bankrupt your business. A full understanding of how your insurance works is hard to come by, but speaking with your insurance provider on a regular basis helps. Here are a few important points related to insurance and mold issues.

1. Mold Damage. Many insurers offer limited coverage for damage to your building because of mold. Your insurance company might reimburse you for costs related to mold repair, removal and restoration.

2. Owner Responsibility. A commercial insurance company takes a hard look at claims that are caused by neglect. For example, if mold is allowed to grow in a building for months or even longer, the insurance provider is likely to deny or limit the scope of a claim. For this reason, if your company experiences a water issue, often a precursor to mold growth, or if mold is found, it is important to take quick action. A local mold mitigation company in South Garland, TX, can help you get an outbreak under control.

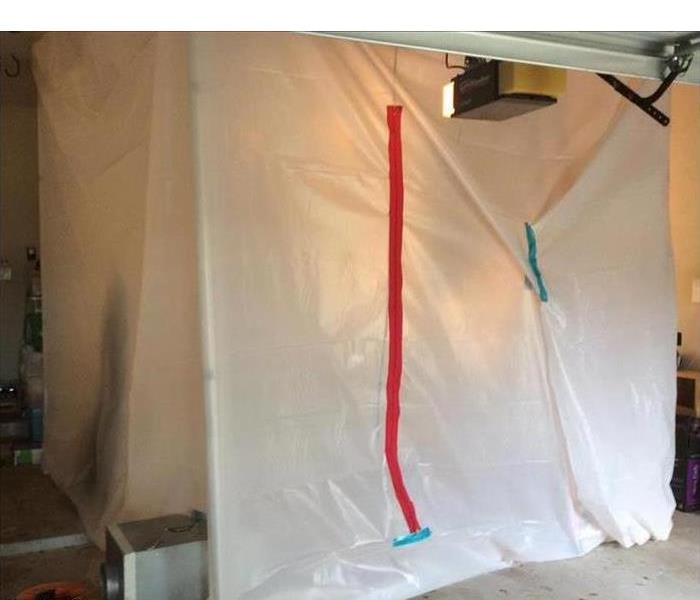

3. Mold Remediation. A professional team has the experience and knowledge to eradicate mold colonies from your building. Technicians will locate the presence of mold, identify the cause of the outbreak and work to restore your building to its original condition. A quality remediation company can help you document expenses and damages for a mold insurance claim.

4. Professional Restoration. In addition to causing musty odors and air quality issues, mold also can break down the structural integrity of materials such as drywall and carpeting. Commercial insurance will often pay for this restoration expense. To find out more, contact your insurance agent for information on your coverage for mold concerns.

24/7 Emergency Service

24/7 Emergency Service